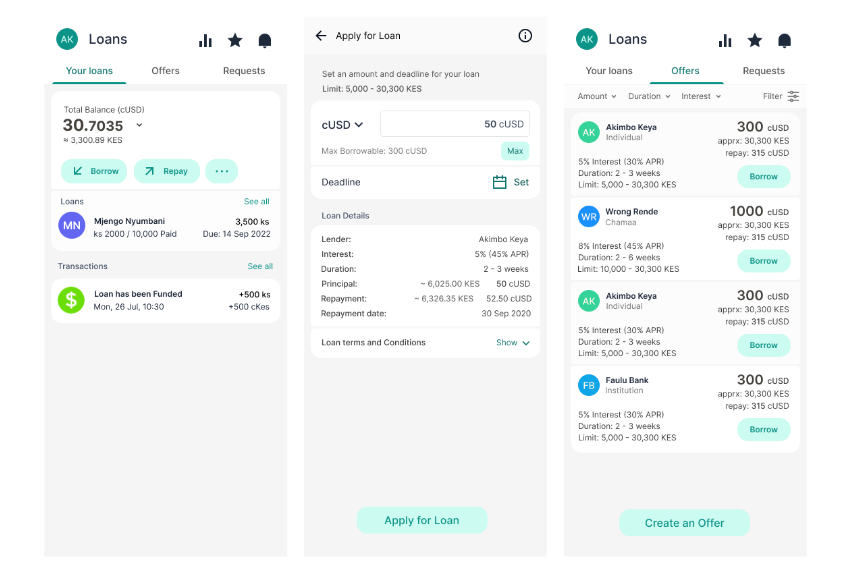

Peer to peer lending: Your own terms

68% of loans in the alternative lending market in Africa are peer-to-peer (P2P). With Clixpesa P2P Lending, users can offer or request loans on their own terms — setting amounts, durations, and interest — while Clixpesa Finance helps reduce risk by monitoring credit profiles and only recommending compatible matches.

Why offer P2P loans on Clixpesa?

P2P lending on Clixpesa democratises access to credit and creates new income streams for users. Key benefits:

- Lower cost of credit: Direct lending between users cuts out intermediaries and reduces fees.

- Flexible terms: Lenders and borrowers set terms that suit their needs — short day loans, multi-week inventory loans, etc.

- New earning opportunities: Lenders earn interest on capital they’d otherwise hold idle.

- Fast access: Offers and requests are discoverable in the app so borrowers can access capital quickly.

- Risk-aware matching: Clixpesa recommends matches based on on-platform credit signals to reduce default risk.

- Automated monitoring & enforcement: Repayments are tracked and the platform follows up on missed payments.

How it works

- Create an Offer (Lender): A user creates a loan offer — specifying currency (e.g. cUSD), amount, interest, maximum duration and any limits (e.g. min/max KES).

- Browse Offers (Borrower): Borrowers browse or filter offers, or see offers recommended for them based on their credit profile and needs.

- Request the Loan: Borrower selects an offer and sends a request.

- Approve & Disburse: Lender reviews the request and, if satisfied, approves and disburses funds to the borrower.

- Repayment & Tracking: Clixpesa tracks scheduled repayments, shows repayment history in the app, and notifies both parties.

- Default Handling: If a borrower misses repayments, Clixpesa follows up and enforces platform policies to reduce losses (notifications, collections workflow, and escalation where needed).

Example (illustrative)

- Offer: Akimbo Keya — 300 cUSD

- Interest: 5% (approx repay 315 cUSD)

- Duration: 2–3 weeks This is the kind of concise offer a lender can create and a borrower can accept in a few taps.

Who benefits?

- Small business owners needing short-term working capital (inventory, supplies).

- Day-loan borrowers who rely on fast, small credit lines to run trade.

- Everyday savers & investors looking to earn interest by lending directly.

- Communities & groups who want flexible peer lending outside traditional banks.

How Clixpesa reduces risk

- Credit scoring & monitoring: We continuously monitor on-platform behaviour and external signals to build trustable credit profiles.

- Smart recommendations: Matches presented to users are filtered and ranked by risk compatibility.

- Transparency & records: Loan terms and repayment history are visible to both parties.

- Operational follow-up: Automated reminders and escalation reduce missed payments; platform policies handle disputes and defaults.

Our vision

We want to make lending fairer, faster, and more accessible by letting people lend to — and borrow from — each other under clear, controllable terms. By combining user control with smart monitoring and built-in enforcement, Clixpesa opens affordable credit to more people while offering new ways to earn.